If you care what happens to your assets after death, and who should be appointed to care for you in a time of need, the contact our office about receiving estate planning services. Our attorneys are experienced at drafting these documents with a personalized touch. We familiarize ourselves with your goals and concerns, your assets, and your family structure. We will work with your existing accountants, financial advisors, life insurance advisors, bankers and brokers as appropriate.

Those who should consider executing estate planning documents:

- Parents of Minor Children

- Non-US Citizens

- Individuals with Beneficiaries who have Special Needs

- Individuals with Beneficiaries who are Young

- Individuals with property located in different states and/or countries

- Blended Families

- Divorcées

- Retirees

- Unmarried Partners

- Individuals where a Baby was born since they last executed estate planning documents

- Individuals where a loved one died since they last executed estate planning documents

- Individuals with estate planning documents that are more than five (5) years old

- Individuals who drafted their own Will or found documents online (we are happy to review to ensure the documents are legally sufficient).

- Everyone

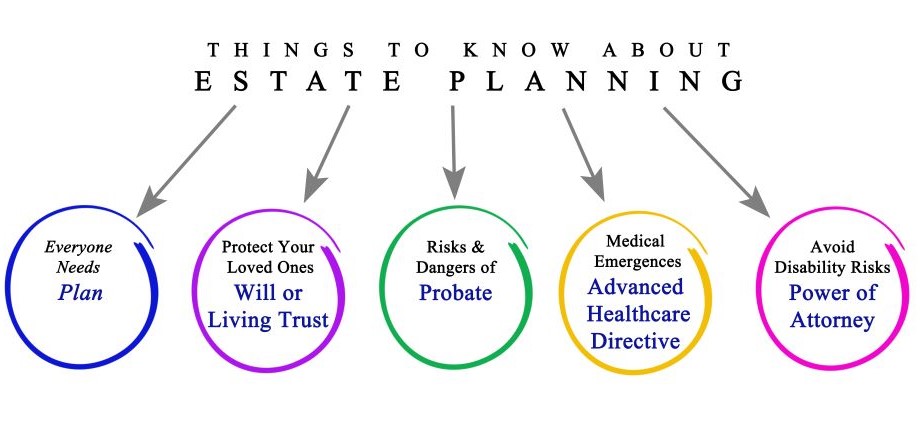

Types of Estate Planning Documents:

- Last Will and Testament

- Codicils (amendment to Last Will & Testament)

- Trusts (Inter Vivos, Testamentary, Revocable, Irrevocable)

- Durable (Financial) Power of Attorney

- Medical Power of Attorney (Healthcare Proxy)

- Advanced Directive

- Living Wills (end of life decisions)

- Spousal Waiver of Election

- Beneficiary Designations

- Special Needs Trusts

- Religious Instruction

- Deeds

We are also experienced in estate litigation. If you are a beneficiary, executor or family member who has concerns about a particular estate, we are happy to advise you of your legal rights.